chgofirefighter

Active Member

I'm new to the ebike world, love my ST2 wondering if insuring it would be a worthwhile investment? Anyone use bike insurance? If so, share experience.... Thanks

I bought Ebike insurance after my next door neighbors garage got broken into and several expensive mountain bikes were stolen. I chain my ST2 to the wall and have a motion detecting camera trained on it as well, I figure I've done just about everything I can do short of sleeping with the darn thing. My understanding is some home owners policies cover liability and theft but need to read the fine print regarding limits and deductibles.

There is a an ebike insurance company that occasionally posts on the forum called Velosurance (https://velosurance.com/). The owner is very helpful and knows the insurance business. I have no affiliation with the company other than being one of their customers.

It's the age old question, "do I need insurance?" With the same answer, "not until your ebike is stolen"

My homeowners covers theft even off property and I also have a product that covers me to a point with my homeowners if I were to get into an accident with the E-Bike that was my fault.

A WASTE of money.

The bike insurance is a waste of money? Because a bike would normally be covered under the homeowner's policy or because the bike insurance company will likely not pay a claim? Do you have personal experience with this? If a $5K bike can be insured during the first couple of years of ownership for a few hundred per year and the insurance company is legit then intuitively it seems it may not be a waste of money (if, like me, this bike might be locked up in a high risk geography). So wondering if you have more details to share?

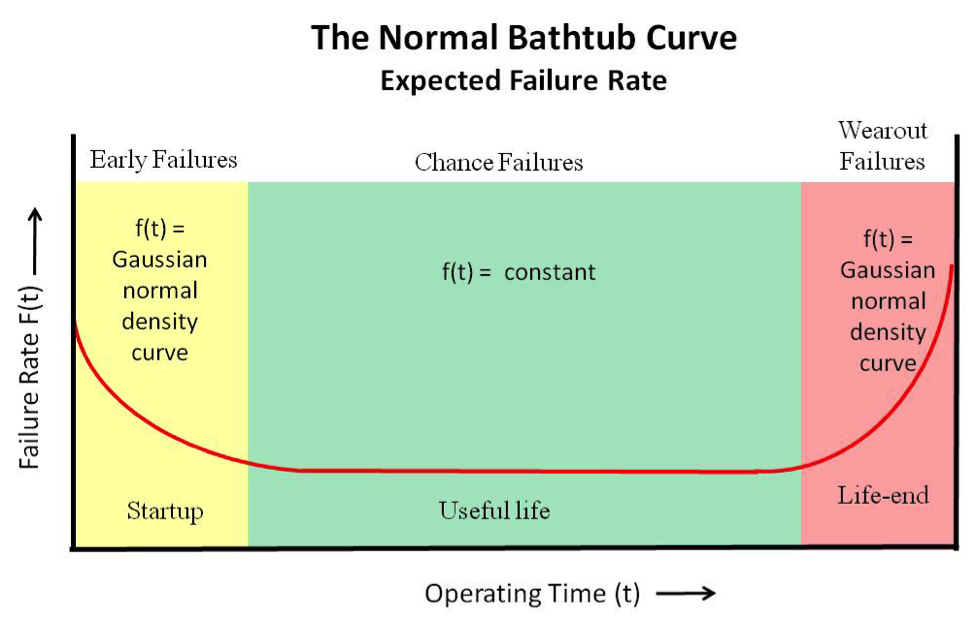

I would agree on extended warranties but the thread is about insurance. Insuring primarily against theft but also other hazards such as accidents. Since I am purchasing a bike primarily for commuting: the best case it will be locked in a public parking garage in downtown Detroit next to my office (daylight hours only). Worst case it will be locked at a public bike rack in the street outside the office. Either way, the risk of theft exists and is greater than if the bike was to be used for leisure purposes only. Aside from theft there are probably also risks associated with commuting such as car/bike collision etc. So is your 'waste of money' comment limited to extended warranties (which I am not asking about) or also to insurance?As a reliability engineer, I learned that failures of stuff (mechanical, electrical) due to manufacturing defects has on a graph a "bathtub curve" ... it is most likely to happen during the warranty period, and unlikely afterwards...It is a waste of money for extended warranties, because odds of failing are very low.