You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wall Street Bets: The EBR Edition

- Thread starter bikeman242

- Start date

ChezCheese:)

Well-Known Member

- Region

- USA

- City

- Kitsap Co, WA

Yeah, I wish I'd bought QS last week, but things that go up like it is doing, often the fervor crashes and it comes down precipitously. Usually just after I buy some  . In which case, all you can do is hang on. If you sell, you reap a loss, but if you are patient, it will go up eventually. Unless it was a scam in the first place. "Pump and dump" kind of thing.

. In which case, all you can do is hang on. If you sell, you reap a loss, but if you are patient, it will go up eventually. Unless it was a scam in the first place. "Pump and dump" kind of thing.

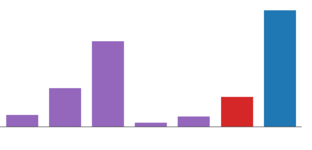

Meanwhile, my solar stocks are doing really well this morning!

Meanwhile, my solar stocks are doing really well this morning!

bikeman242

Active Member

I had to look up what a SPAC is:

"A SPAC is generally formed by a group of investors, called sponsors, with a strong background in a particular industry or business sector. They raise funds from other investors, and use the money to acquire an existing, privately held company — and then take it public in an IPO.

When they launch the SPAC, the sponsors generally either don't have a specific target in mind, or they're not ready to name it in order to avoid the extensive paperwork and disclosures required by the Securities and Exchange Commission (SEC)."

So you're gambling on a longshot without actually knowing what company the SPAC is going to launch an IPO for. I guess I think that is putting way too much faith in people you know zilch about, and who aren't even going to tell you what horse it is you are investing in, because they don't want to have to do the needed paperwork, which was probably put into place by the SEC to prevent fraud. Hmmmn.

You put your confidence in the management of the SPAC company. In the case of BTWN, you are trusting Peter Thiel with your money.

There is of course risk, though take a look at the return of BTWN since the date of my original post.

bikeman242

Active Member

Same opinion here. And soon, US will also ban ICE car sales after 2030 ,maybe earlier ; oil will be less then 5$/barrel. I've opened in summer a postion in Stlhf, Cbat . Missed QS , but can't catch all of them.

Car Part | 14 Countries Banning Fossil Fuel Vehicles: Norway Leads in 2025

Several countries around the world are encouraging their citizens to move away from gasoline-powered vehicles. The following countries have also announced plans to ban diesel and petrol cars in the future.carpart.com.au

Oil is a long term holding position and stocks in big oil, and, especially, exploration and production stocks are trading at extremely depressed values. Dividends remain high and stable.

It is my opinion that there is simply no way that in 10 years oil will be $5/barrel. My midcycle target price for west texas intermediate is $55/barrel.

ICE cars make up about 25% of total oil use. If you strongly believe that oil prices will freefall, I suggest buying a general utility ETF like ticker symbol VPU. The nations infrastructure will need massive upgrading to accommodate all those charging stations. Utility companies should be the likely benefit.

Disclosure - I am also long utilities, but not because I believe in the rapid conversion to electric vehicles, but for the long-term stable equity return and dividend yield

bikeman242

Active Member

I present my next pick as a long term hold, for dividend yield and equity return: IMBBY.

Ravi Kempaiah

Well-Known Member

- Region

- Canada

- City

- Halifax

Taylor57

Well-Known Member

Why fight it?

:max_bytes(150000):strip_icc()/shutterstock_353934110-5bfc449446e0fb00514a9dff.jpg)

www.investopedia.com

www.investopedia.com

:max_bytes(150000):strip_icc()/shutterstock_353934110-5bfc449446e0fb00514a9dff.jpg)

Buffett's Bet with the Hedge Funds: And the Winner Is …

In 2008, Warren Buffett placed a million-dollar bet that an S&P 500 index fund would beat the funds of funds hedge fund managers would select.

ChezCheese:)

Well-Known Member

- Region

- USA

- City

- Kitsap Co, WA

Tobacco?? How very retro of you! Won't catch me betting on poison.I present my next pick as a long term hold, for dividend yield and equity return: IMBBY.

FlatSix911

Well-Known Member

- Region

- USA

- City

- Silicon Valley

How True! The Market Index wins over time and always beats the fund managers.Why fight it?

:max_bytes(150000):strip_icc()/shutterstock_353934110-5bfc449446e0fb00514a9dff.jpg)

Buffett's Bet with the Hedge Funds: And the Winner Is …

In 2008, Warren Buffett placed a million-dollar bet that an S&P 500 index fund would beat the funds of funds hedge fund managers would select.www.investopedia.com

Attachments

FlatSix911

Well-Known Member

- Region

- USA

- City

- Silicon Valley

BMW wanna be?!Why did BYD change their logo?

QS is trading at $51 this morning !

https://www.marketwatch.com/story/q...an-30-its-most-ever-11609788865?siteid=yhoof2

QuantumScape stock falls more than 30%, its most ever .

https://www.marketwatch.com/story/q...an-30-its-most-ever-11609788865?siteid=yhoof2

QuantumScape stock falls more than 30%, its most ever .

Last edited:

ChezCheese:)

Well-Known Member

- Region

- USA

- City

- Kitsap Co, WA

Now is a chance to buy then, if you want to.

Ademi LLP Investigates Claims of Securities Fraud of QuantumScape Corporation

The Law Offices of Frank R. Cruz Announces Investigation of QuantumScape Corporation (QS) on Behalf of Investors

Glancy Prongay & Murray LLP, a Leading Securities Fraud Law Firm, Announces Investigation of QuantumScape Corporation (QS) on Behalf of Investors

Wolf Haldenstein Announces a QuantumScape Corporation Class Action Investigation Alert

"The investigation focuses on whether QuantumScape properly disclosed the significant limitations of its solid-state battery products in order to be acceptable for real world field electric vehicle performance. Specifically, according to a Seeking Alpha research report, QuantumScape's solid state battery products (i) last only for "260 cycles or about 75,000 miles of aggressive driving", (ii) have a daily range of only about "75-100 miles at full capacity in winter temperature conditions", (iii) will charge only to 5% in 15 minutes rather than 80% at 15 minutes in winter conditions, and (iv) will have an energy density lower than competitors."

The Law Offices of Frank R. Cruz Announces Investigation of QuantumScape Corporation (QS) on Behalf of Investors

Glancy Prongay & Murray LLP, a Leading Securities Fraud Law Firm, Announces Investigation of QuantumScape Corporation (QS) on Behalf of Investors

Wolf Haldenstein Announces a QuantumScape Corporation Class Action Investigation Alert

"The investigation focuses on whether QuantumScape properly disclosed the significant limitations of its solid-state battery products in order to be acceptable for real world field electric vehicle performance. Specifically, according to a Seeking Alpha research report, QuantumScape's solid state battery products (i) last only for "260 cycles or about 75,000 miles of aggressive driving", (ii) have a daily range of only about "75-100 miles at full capacity in winter temperature conditions", (iii) will charge only to 5% in 15 minutes rather than 80% at 15 minutes in winter conditions, and (iv) will have an energy density lower than competitors."

Last edited:

ChezCheese:)

Well-Known Member

- Region

- USA

- City

- Kitsap Co, WA

Good research, e-boy! That may be why it plummeted. Best to stay away then.

Meanwhile, EVs are taking over the Norwegian car market: https://www.theguardian.com/environ...arket-share-norway?CMP=Share_AndroidApp_Other

Meanwhile, EVs are taking over the Norwegian car market: https://www.theguardian.com/environ...arket-share-norway?CMP=Share_AndroidApp_Other

bikeman242

Active Member

Continuing to load up on BTWNW warrants on this end.

I hold exotic stuff like VINIX (lookup the ticker!)

In all seriousness, I used to work in financial services and it was always a chore to get people to diversify away from their concentrated (read: individual equity) holdings. They thought they were winners or and that they were clued in.

But! I do appreciate throwing some fun money around. If I were to throw money down, it would be on Chinese firms. Tencent, BYBD, Huawei, etc.

In all seriousness, I used to work in financial services and it was always a chore to get people to diversify away from their concentrated (read: individual equity) holdings. They thought they were winners or and that they were clued in.

But! I do appreciate throwing some fun money around. If I were to throw money down, it would be on Chinese firms. Tencent, BYBD, Huawei, etc.

ChezCheese:)

Well-Known Member

- Region

- USA

- City

- Kitsap Co, WA

Stock market is very happy today. Solar stocks are way up, and everything else is up at least a bit.

Ebiker01

Well-Known Member

Did anyone invest in NIO or Xpeng?

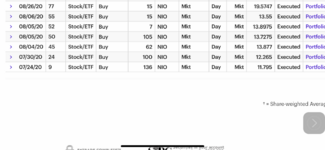

About 450shares in Nio @ avg . 14$, sold it all @57.50, ~ 19k profit that i had reinvested it. In the EV sector i also have tsla , xpev , li, byddf , wlmtf, gelyf.

It's still a great price to get in with Nio, this one will be 200-300 bucks/share in 9-16months. Will the oil soon becoming obsolete , actually all of the tickers mentioned above will keep on climbing the mountain ahead.

Attachments

Last edited:

Similar threads

- Replies

- 94

- Views

- 30K

- Replies

- 1

- Views

- 7K

- Replies

- 2

- Views

- 3K

- Replies

- 5

- Views

- 6K